November 2025 Market Recap

November lived up to its reputation as a seasonally strong month for equities, but the rally was anything but smooth. The news cycle was defined by the ending of the longest government shutdown on record, the emerging fragility of the AI boom, and a Federal Reserve tasked with navigating foggy waters to support a weakening labor market without stoking already sticky inflation.

Equity Markets

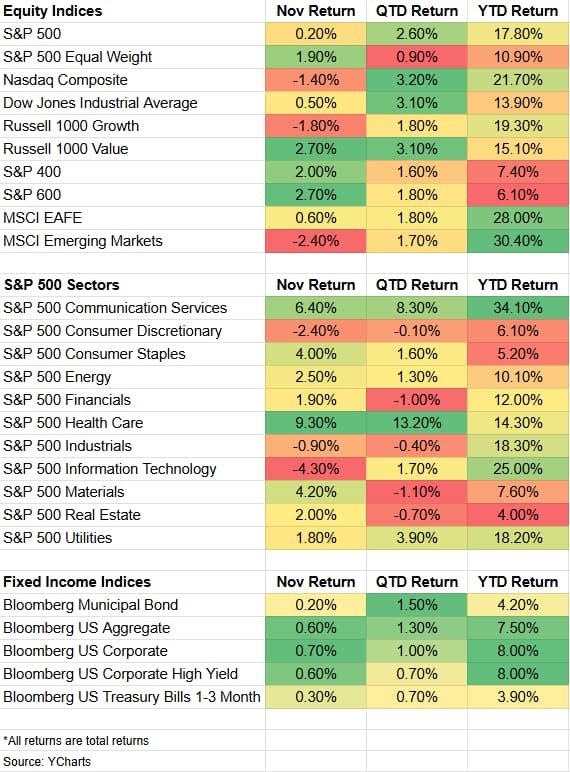

The S&P 500 managed to extend its monthly winning streak to seven as it gained 0.2%, despite at one point falling over 5% from its October high. The Nasdaq ended its own seven-month winning streak after falling 1.4%. Investor scrutiny over AI stock valuations and debt issuance for AI-related capital expenditures weighed on markets, while spillover effects from the Fed’s October meeting added to the pressure. Markets rallied sharply late in the month as December rate cut probabilities reversed course.

Market breadth was a bright spot, rewarding diversified equity investors in November. The equal-weighted version of the S&P 500 index returned 1.9%. Value-oriented sectors like consumer staples and healthcare rallied, while growth-oriented sectors like information technology and consumer discretionary pulled back. Smaller companies strongly outperformed, as the S&P 400 and S&P 600 returned 2% and 2.6%, respectively. On the international front, developed markets ended positively as the MSCI EAFE gained 0.6%, while emerging markets lost steam after a strong year-to-date run through October, losing 2.4%.

Fixed Income Markets

Rates ultimately drifted lower across the curve in November, but they weren’t immune to the volatility. The 10-year Treasury spiked as high as 7bps before ultimately settling 8bps lower at 4.01% at month-end. Bonds benefited from the decline in rates as the Bloomberg US Aggregate Bond index gained 0.6%, and the Bloomberg Municipal Bond index gained 0.2%.

Economy & Fed

The longest U.S. government shutdown on record ended midway through November, but delays in official economic data continued to cloud the economic outlook. The October CPI report was ultimately cancelled because the BLS was unable to retroactively collect data, and the PCE report was delayed until December, leaving the Fed with an opaque view on inflation.

The October non-farm payrolls report was delayed until early December, but the private ADP report showed the economy added just 42,000 jobs in October. This was a reversal from Septembers contraction, but still a considerable slowdown from earlier in the year.

Fed meeting minutes showed many officials supported a “wait and see” approach given the economic uncertainty, causing the market probability of a December cut to dip to around 30% mid-month. Late-month dovish comments from Fed Governor Williams caused a reversal, sending the probability of a December cut back up to 80% and ultimately helped markets rally back from their mid-month weakness.

Brendan Moleski, CFA

Head of Trading & Analytics